Our Financials tab is your go-to place for understanding how Lakeland responsibly manages resources.

Here, the community can:

Explore budget reports and see where funds are allocated.

Access annual financial statements and audit results.

Learn about funding sources that support programs, staff, and student opportunities.

Discover how we maintain transparency, accountability, and stewardship of school resources.

We’re committed to keeping our community informed and confident in how every dollar is used to support student success.

Lakeland Financial Highlights

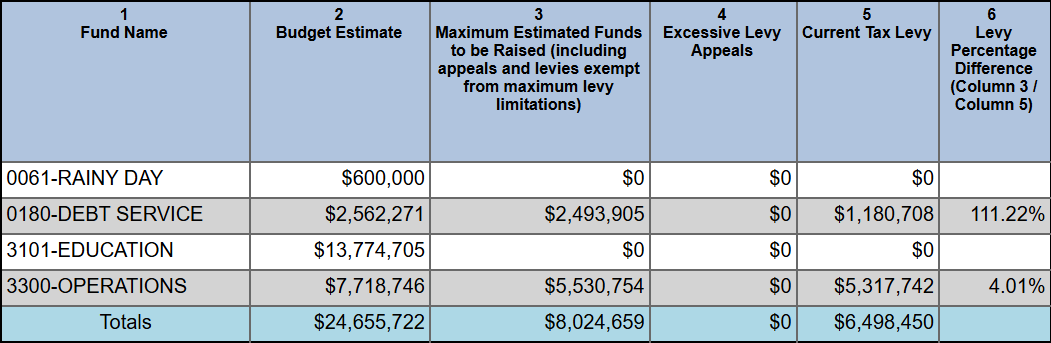

2026 Lakeland Budget

Proposed Bond Spending

What are recent legislation changes and tax caps doing to public school funding?

Indiana's property tax caps, established in 2010, limit annual increases in property tax bills—1% for homesteads, 2% for residential properties and agricultural land, and 3% for nonresidential properties. While intended to provide tax relief, these caps have led to substantial revenue losses for public schools. In 2023 alone, schools lost approximately $365 million due to these caps.

Further exacerbating the issue, Senate Bill 1, signed into law in 2025, is projected to reduce school funding by about $744 million over three years. This includes a requirement for districts to share a portion of their property tax revenue with charter schools, starting at 25% in 2028 and increasing to 100% by 2030.

As these legislative changes take effect, public schools in Indiana face a complex financial landscape. While state funding increases provide some relief, the combined effects of property tax caps and mandated revenue sharing with charter schools present ongoing challenges. Continued community engagement and advocacy will be crucial in ensuring that public schools can maintain quality education amid these financial constraints.

What is the difference between a bond and a referendum?

Bond

A bond is a way for a school district (or government) to borrow money to pay for large projects like building new schools, renovating facilities, or buying equipment.

The district pays back the money over time with interest, usually through property taxes.

Bonds require voter approval in most cases, but they are specifically about borrowing money, not general policy decisions.

Think of it like a loan that the community backs.

Referendum

A referendum is a vote by the community on a specific issue — it could be about funding, taxes, school policies, or other important decisions.

In schools, referendums often ask voters to approve or reject a proposed tax increase or budget allocation.

A referendum is broader than a bond — it’s not just about borrowing money; it can cover many types of decisions.

Key Differences:

Bond: | Referendum: | |

|---|---|---|

Purpose: | Borrow money for projects | Make a community decision on a proposal (often funding day to day operations OR safety) |

Result: | The school can issue debt if approved | The community approves or rejects a proposal |

Scope: | Always financial (debt) | Can be financial or policy-related |

Repayment: | Paid back over time with interest | Not applicable (depends on what is approved) |